Last Will and Testament Form samples

What is a Last Will and Testament?

If you prefer your property to be handled according to your wish after your death, you need to write a Will. To do so, you shall be in sound mind and of legal age. There is a number of reasons to opt for a Last Will and Testament, as a part of your life and death planning. For example, you want your estate to be distributed to certain individuals and organizations, instead of leaving it to your state’s law or government to define it, once you die. You have minor children or elderly parents to take care of, so you need to think about their guardian, or you have to assign a caregiver to your companion animals.

Make and sign Last Will and Testament form by State

| US State | State Laws | Signing Requirements |

| Alabama | consult Title 43, Chapter 8 for legal requirements for a Last Will | Two Witnesses (according to § 43-8-131), not always possible to sign online |

| Alaska | consult Title 13, Chapter 12 for legal requirements for a Last Will | Two Witnesses (according to AS 13.12.502) |

| Arizona | consult Title 14 for legal requirements for a Last Will | Two Witnesses (according to § 14-2502) |

| Arkansas | consult Title 28 for legal requirements for a Last Will | Two Witnesses (according to A.C.A. § 28-25-103) |

| California | consult Sections 6100 to 6139 for legal requirements for a Last Will | Two Witnesses (according to § 6111), signature with date |

| Colorado | consult CRS Title 15 for legal requirements for a Last Will | Two Witnesses can be substituted by a Notary Public (according to § 15-11-502) |

| Connecticut | consult Chapter 802a for legal requirements for a Last Will | Two Witnesses (according to § 45a-251) |

| Delaware | consult Title 12 for legal requirements for a Last Will | Two Witnesses (according to DE Title 12, Chapter 2 § 201, 202) |

| Florida | consult Chapter 732 for legal requirements for a Last Will | Two Witnesses (according to FL Section 732.502) |

| Georgia | consult Title 53 for legal requirements for a Last Will | Two Witnesses (according to GA Section 53-4-20) |

| Hawaii | consult Chapter 560 for legal requirements for a Last Will | Two Witnesses (according to HRS 560:2-502) |

| Idaho | consult Title 15 for legal requirements for a Last Will | Two Witnesses (according to ID Section 15-2-502) |

| Illinois | consult 755 ILCS 5 for legal requirements for a Last Will | Two Witnesses (according to 755 ILCS 5/4-3) |

| Indiana | consult Title 29 for legal requirements for a Last Will | Two witnesses or includes a self-proving clause instead (according to IC-29-1-5-3) |

| Iowa | consult Chapter 633 for legal requirements for a Last Will | Two Witnesses (according to § 633.279) |

| Kansas | consult Chapter 59 for legal requirements for a Last Will | Two Witnesses (according to § 59-606) |

| Kentucky | consult Chapter 394 for legal requirements for a Last Will | Two Witnesses (according to § 394.040) |

| Louisiana | consult CC 1570 for legal requirements for a Last Will | Two Witnesses together with a Notary Public (according to Art. 1577) |

| Maine | consult Title 18-A, Article 2 for legal requirements for a Last Will | Two Witnesses (according to § 2-502) |

| Maryland | consult Title 4 for legal requirements for a Last Will | Two Witnesses (according to § 4-102) |

| Massachusetts | consult Chapter 190B for legal requirements for a Last Will | Two Witnesses (according to § 2-502) |

| Michigan | consult Act 386 of 1998 for legal requirements for a Last Will | Two Witnesses (according to § 700-2502) |

| Minnesota | consult Chapter 524 for legal requirements for a Last Will | Two Witnesses (according to § 524.2-502) |

| Mississippi | consult Title 91, Chapter 5 for legal requirements for a Last Will | Two or more Witnesses, if not only testator writes and signs a Will (according to § 91-5-1) |

| Missouri | consult Chapter 474 for legal requirements for a Last Will | Two Witnesses (according to § 474.320) |

| Montana | consult Title 72 for legal requirements for a Last Will | Two Witnesses (according to § 72-2-522) |

| Nebraska | consult Chapter 30 for legal requirements for a Last Will | Two Witnesses (according to § 30-2327) |

| Nevada | consult Title 12 for legal requirements for a Last Will | Two Witnesses (according to NRS 133.040) |

| New Hampshire | consult Chapter 551 for legal requirements for a Last Will | Two or more Witnesses (according to § 551:2) |

| New Jersey | consult Title 3B for legal requirements for a Last Will | Two or more Witnesses (according to § 3B:3-2) |

| New Mexico | consult Chapter 45 for legal requirements for a Last Will | Two Witnesses (according to § 45-2-502) |

| New York | consult Estates, Powers, and Trusts for legal requirements for a Last Will | Two Witnesses (according to § 3-2.1) |

| North Carolina | consult Chapter 31 for legal requirements for a Last Will | Two Witnesses (according to G.S. 31-3.3) |

| North Dakota | consult Chapter 30.1-08 for legal requirements for a Last Will | Two Witnesses at a minimum or a Notary Public (according to 30.1-08-02) |

| Ohio | consult Chapter 2107 for legal requirements for a Last Will | Two Witnesses (according to ORC 2107.03) |

| Oklahoma | consult Title 84 for legal requirements for a Last Will | Two Witnesses (according to O.S. § 84-55), may include notarization |

| Oregon | consult Chapter 112 for legal requirements for a Last Will | Two Witnesses (according to ORS 112.235) |

| Pennsylvania | consult Title 20 for legal requirements for a Last Will | Two Witnesses, in case signed by someone else on behalf of a grantor (according to § 2502) |

| Rhode Island | consult Title 33 for legal requirements for a Last Will | Two Witnesses (according to § 33-5-5) |

| South Carolina | consult Title 62 for legal requirements for a Last Will | Two Witnesses (according to § 62-2-502) |

| South Dakota | consult Chapter 29A-1 for legal requirements for a Last Will | Two Witnesses (according to § 29A-2-502) |

| Tennessee | consult Title 32 for legal requirements for a Last Will | Two Witnesses at a minimum (according to § 32-1-104) |

| Texas | consult Probate Code for legal requirements for a Last Will | Two Witnesses at a minimum at the age 14+ (according to § 251.051) |

| Utah | consult Title 75 for legal requirements for a Last Will | Two Witnesses (according to 75-2-502) |

| Vermont | consult Title 14 for legal requirements for a Last Will | Two or more Witnesses (according to 14 V.S.A. § 5) |

| Virginia | consult Title 64.2 for legal requirements for a Last Will | Two Witnesses (according to § 64.2-403) |

| Washington | consult Title 11 RCW for legal requirements for a Last Will | Two Witnesses at a minimum (according to RCW 11.12.020) |

| West Virginia | consult Chapter 41 for legal requirements for a Last Will | Two Witnesses (according to § 41-1-3) |

| Wisconsin | consult Chapter 853 for legal requirements for a Last Will | Two Witnesses (according to § 853.03) |

| Wyoming | consult Title 2 (Wills, Decedents’ Estates and Probate Code) for legal requirements for a Last Will | Two Witnesses (according to § 2-6-112) |

A Step-by-Step Process of How to make a Will

Step 1. Identify Your Belongings, Savings and Assets

First of all, you need to create a list of all estate that you possess and value. The items shall contain your real property and personal belongings. It should be done even before you create a document. You need to be sure about who are your beneficiaries, information about them (names, dates of birth etc.). Choose carefully which assets, if any, you wish to give to certain people in your will, and who should receive nothing and why, if it comes to your mind. If you have real estate, describe it in details mentioning someone to take it. Don’t forget about the correct total percentage of 100% and dividing it between all the beneficiaries.

Step 2. Choose the Executor

In other words, a person who is responsible for dividing and delivering to correct beneficiaries all your assets when you’re gone, as well as upholding your will. An executor cannot be your relative. Just in case, name one more person as your secondary executor if the first one cannot or refuses to perform the tasks. Better choose someone you can trust and who will act in your best interests.

Step 3. Name Guardian For Your Kids

If you don’t want your minor children to have an unclear fate, take care of them by appointing a person named Guardian in case you die. The guardian will replace you as a parent and take care for your children instead of you, so make sure this person is absolutely trustworthy and certainly can act in your name and look out for your kids and their belongings. It’s essential as well to list your children in your will and mention their names and birth dates.

Step 4. Select Your Beneficiaries

As it has been mentioned in Step 1, you need to choose your beneficiaries carefully, because these are the people or organizations who will receive everything yours after your death. It’s your choice whether to have one beneficiary who will collect everything, or to divide your property amongst a lot of people. Think about the interest in case your beneficiary dies – if it goes to their heirs or will be divided among the other beneficiaries, if you have multiple.

Step 5. Find Witnesses and Sign Your Will in Front of Them

In order to make your Last Will legal, you need to sign it at least in front of one witness. But it is recommended to have two witnesses, because a lot of states have such a requirement. It’s better for witnesses not to be your beneficiaries, as well as executors. Don’t forget to arrange the notarization and sign the Will after, not in front of a notary.

Step 6. Find a Safe Place to Store Your Will

Put your document in a safe place. It should be stored with original copies. Make sure your beneficiaries and legal counsel have these copies too.

How Do I Write a Last Will and Testament?

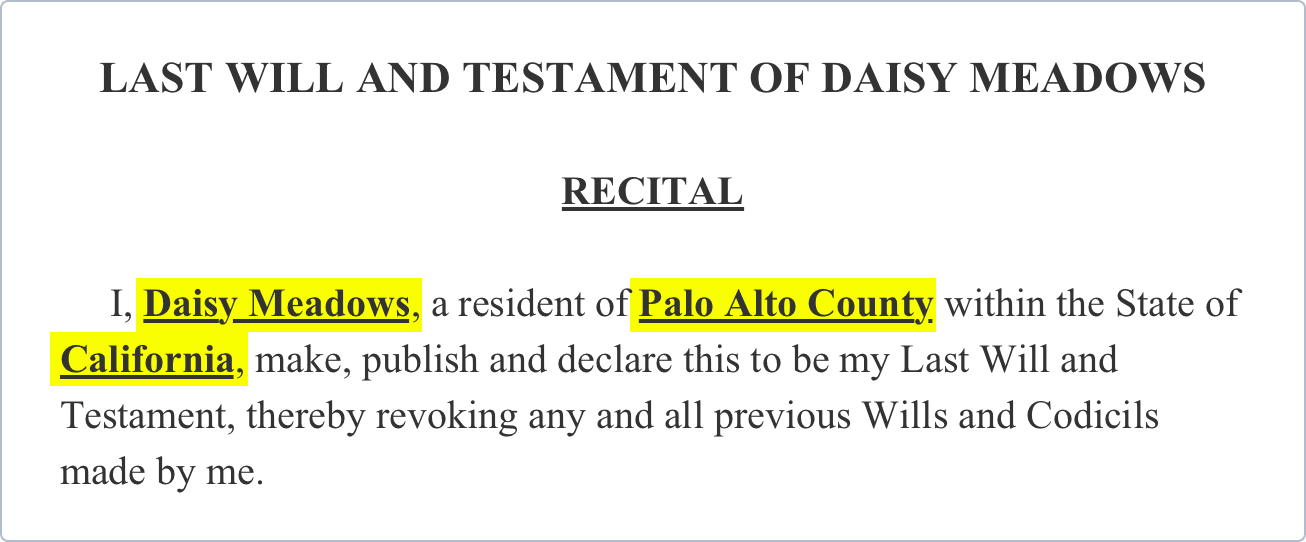

Step 1. Name a Testator

A Testator is in our case a person who will give their property after death – that means you. Here you need to state your name in the correct areas.

Last Will and Testament of William Smith

Recital

I, William Smith, a resident of Houston within the State of Texas, make, publish and declare this to be my Last Will and Testament, thereby revoking any and all previous Wills and Codicils made by me.

Step 2. Mention Family Members

This step includes your marital status. You need to declare it – whether you are single, married, engaged, widowed or separated – please write it down, including the name of the other person.

Relatives

I, William Smith, attest that I am single.

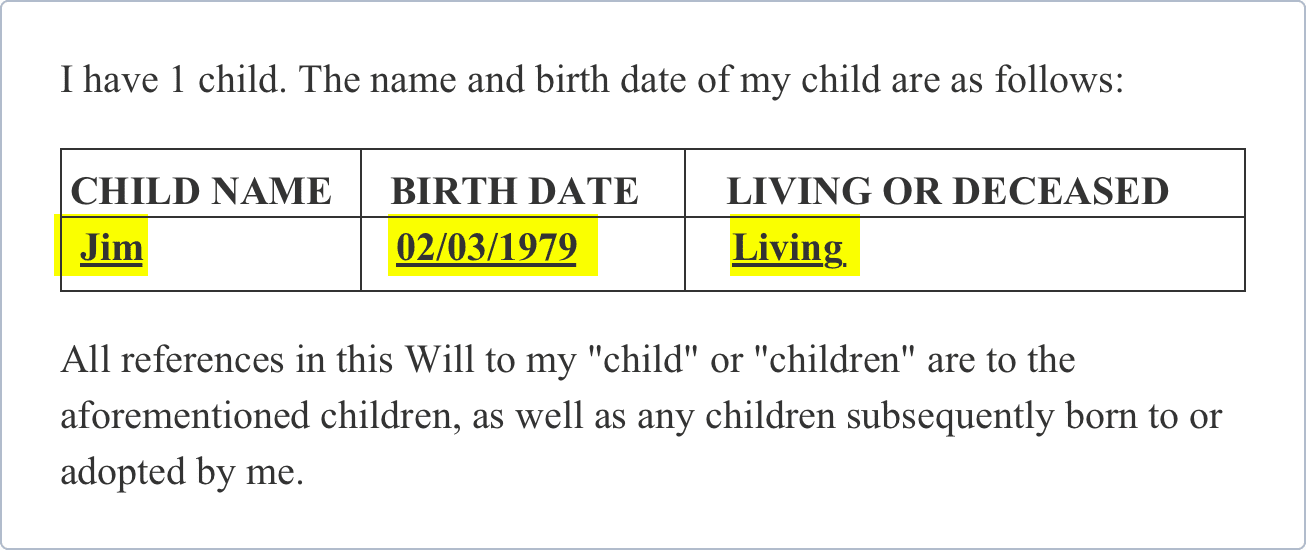

Step 3. Mention Kids

Fill in the information about your children: how many of them you have, their names, birth dates, whether they are living or deceased.

I have 1 child. The name and date of birth of my child are as follows:

Mariah15/03/1990Living

All references in this Will to my “child” or “children” are to the aforementioned children, as well as any children subsequently born to or adopted by me.

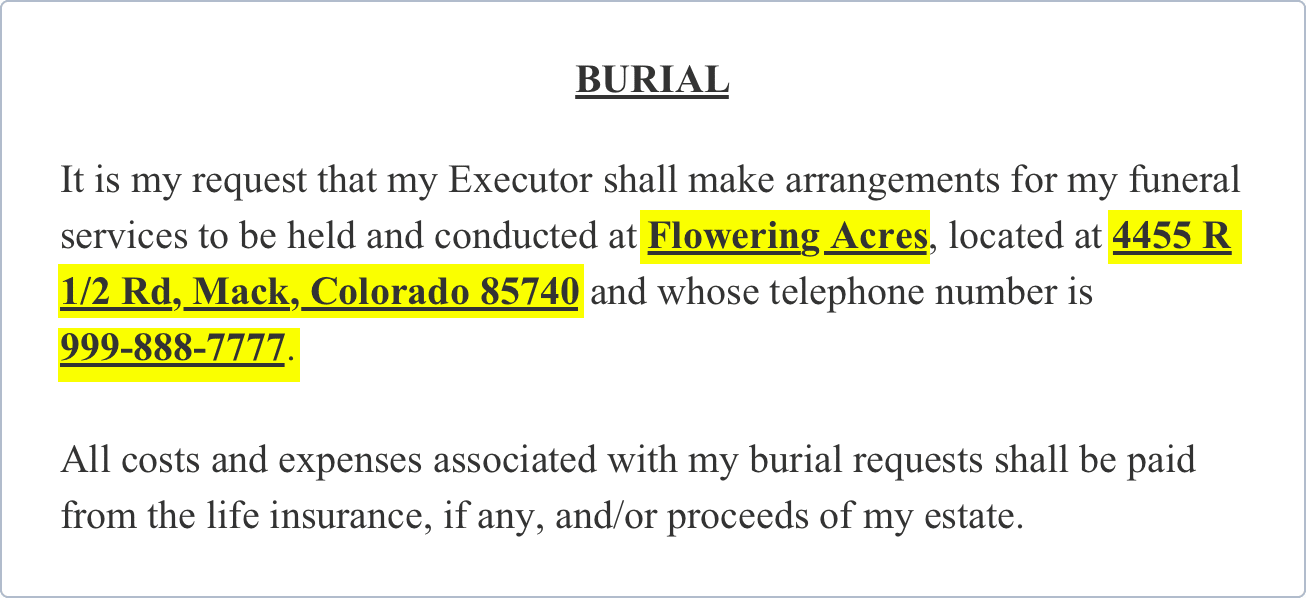

Step 4. Funeral and Burial Arrangements

Here you should list all your arrangements connected with funeral, burial and memorial wishes. If you’ve made a choice about your funeral home, list all the necessary data: its name, address, telephone number. If you want a repast, give the details: address and location. As for the burial, list the name of the cemetery and address as well. Don’t forget to mention any memorial wishes, if you have them, in this very step.

Burial

It is my request that my Executor shall make arrangements for my funeral services to be held and conducted at Bradshaw-Carter Memorial & Funeral Services, located at 1734 W Alabama St, Houston, TX 77098 and whose telephone number is 713-804-7395.

All costs and expenses associated with my burial requests shall be paid from the life insurance, if any, or proceeds of my estate.

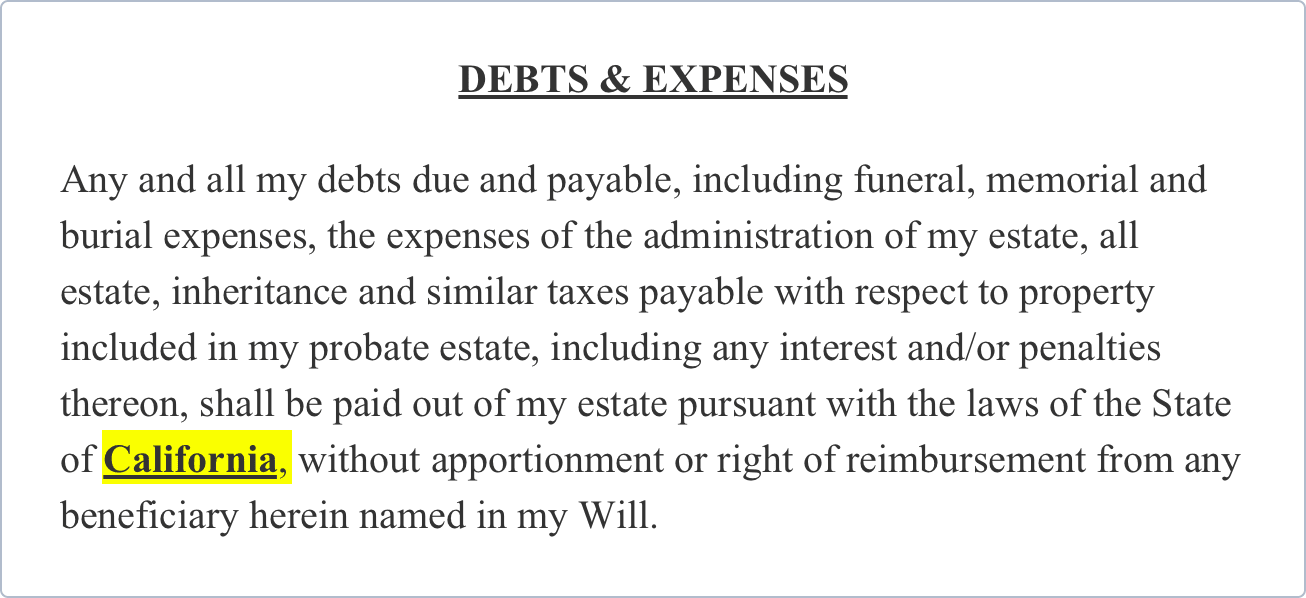

Step 5. Mention your Expenses and Debts

Here declare laws of the state where any assets, debts or taxes will be subject to accordingly.

Debts & Expenses

Any and all my debts due and payable, including funeral, burial and memorial expenses, the expenses of the administration of my estate, all estate, inheritance and similar taxes payable with respect to property included in my probate estate, including any interest or/and penalties thereon, shall be paid out of my estate pursuant with the laws of the State of Texas, without apportionment or right of reimbursement from any beneficiary herein named in my Will.

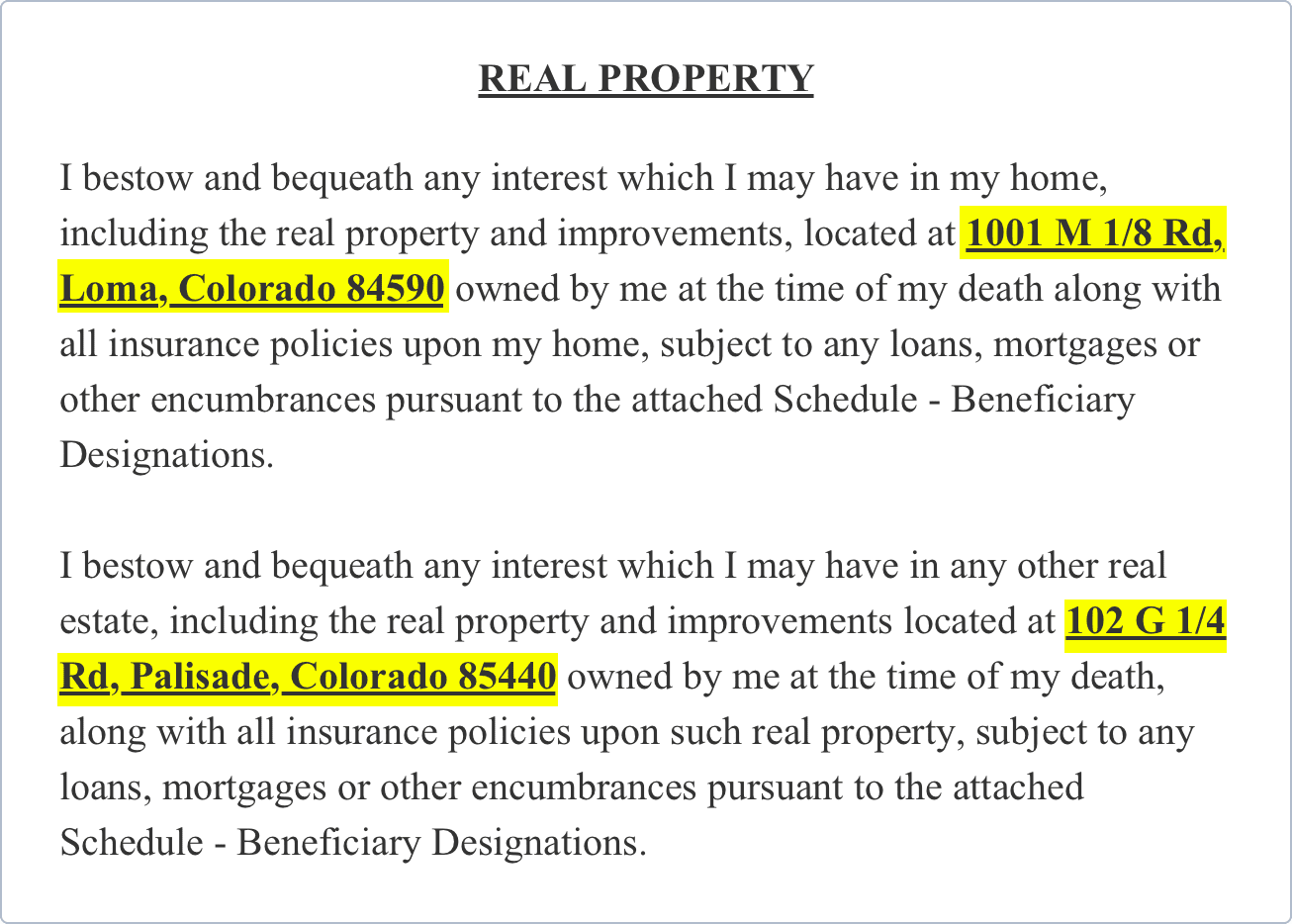

Step 6. Describe Your Estate

If you have any real estate, mention it in this step. Write the addresses of your home or property here.

Real property

I bestow and bequeath any interest which I may have in my home, including real property and improvements, located at 700 East Parker – Houston, TX – 77076-3413 owned by me at the time of my death along with all insurance policies upon my home, subject to any loans, mortgages or other encumbrances pursuant to the attached Schedule – Beneficiary Designations.

Step 7. Care of Your Pets

Give the information of the caretaker or pet organization if you have pets and want someone to take care of them after you’re gone – name and address are essential. Don’t forget to mention pet type, their names and veterinarians.

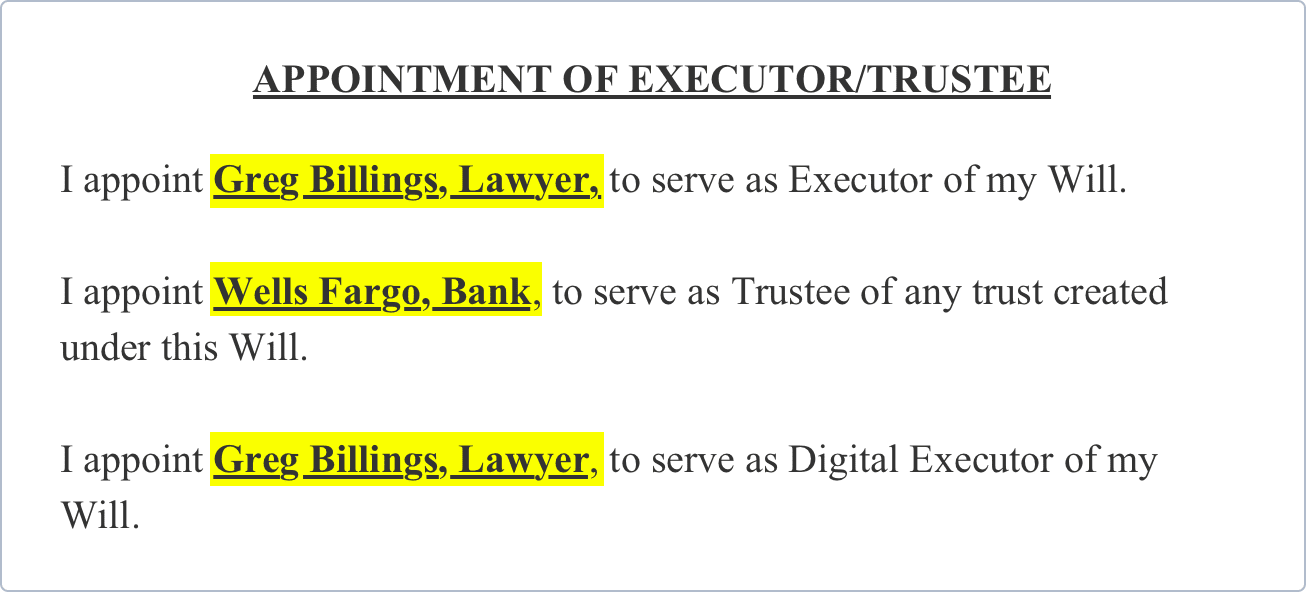

Step 8. Appointment Of Trustee or Executor

Here you need to put your Executor/Trustee’s name and how they relate to you. Don’t forget to put the secondary executor if your primary is somehow unavailable. Digital Executor could also be useful if you have some digital assets.

Appointment of Executor/Trustee

I appoint Gregory McNeal, Lawyer, to serve as Executor of my Will.

I appoint Fabio Allonzo, Lawyer, to serve as Digital Executor of my Will.

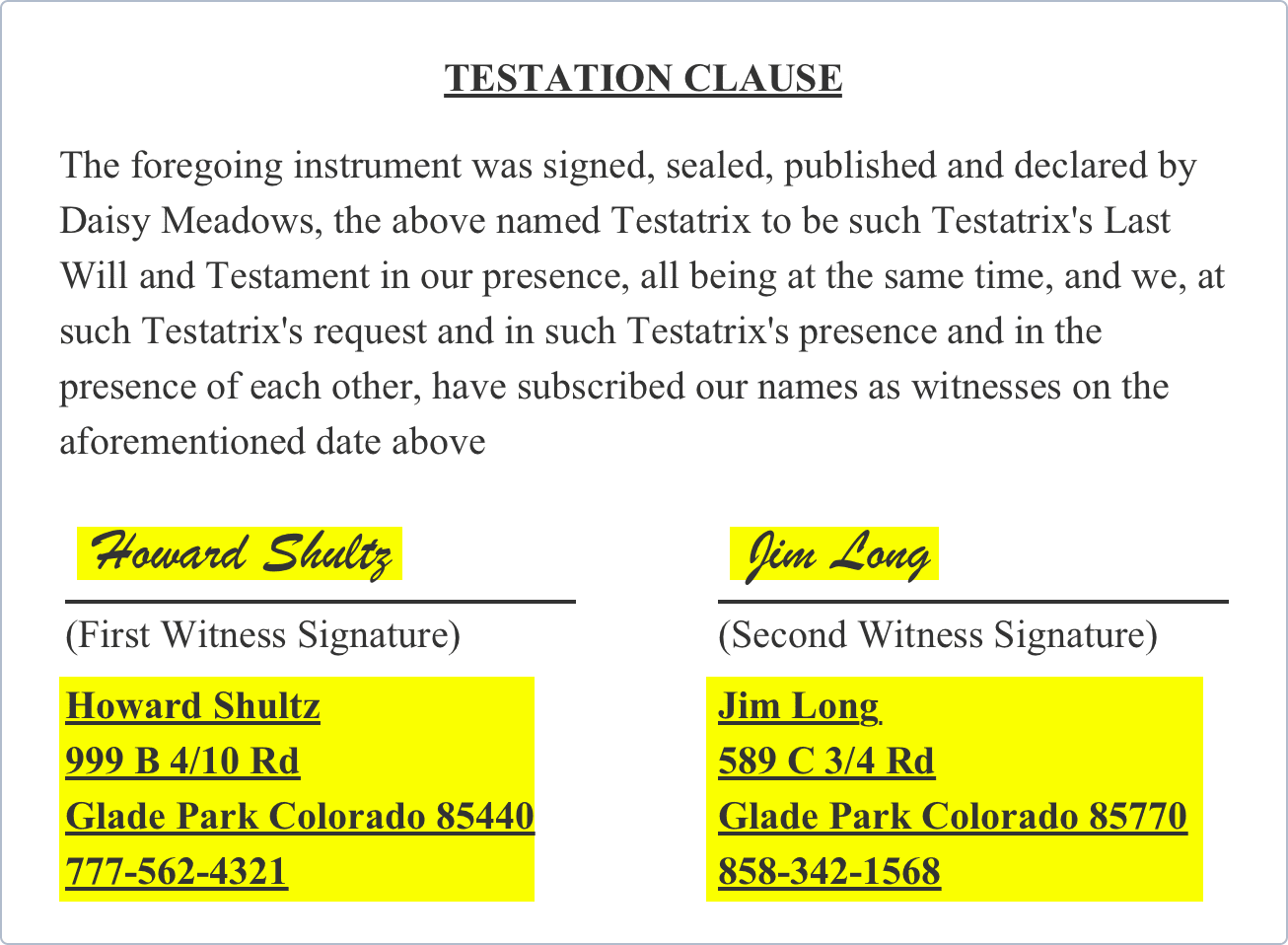

Step 9. Testation Clause

This is the last step of writing your Last Will. It allows you to state that your wishes are of sound mind and to certify your Will. To do so, input your name and signature in this section. Then let your witnesses to provide signatures and names, addresses and telephone numbers.

Testation Clause

The foregoing instrument was signed, sealed, published and declared by William Smith, the above named Testatrix to be such Testatrix’s Last Will and Testament in our presence, all being at the same time, and we, at such Testatrix’s request and in such Testatrix’s presence and in the presence of each other, have subscribed our names as witnesses on the aforementioned date above

Mary Williams Sofy Dexter

(First Witness Signature) (Second Witness Signature)

Mary Williams Sofy Dexter

150 W Parker Rd 6006 North Fwy

Houston, TX 77076 Houston, TX 77076

281-483-5529 712-694-5570

How to Amend a Will using Codicil

In case any amendments, further clarification or additions are needed to be done to a previously written Will, a Codicil should be used. Sometimes known as Addendum to a Last Will, it is a legal document, registering any major changes in life of a Testator and their effect on arrangements reflected in a Will created earlier. At the same time, a Codicil should not alter entirely the essence of the original Last Will.

Download a Last Will And Testament PDF or Microsoft Word Template

FAQ (Frequently Asked Questions)

Does Microsoft Word have a will template?

The Last Will and Testament Template, available for free, is compatible with all Microsoft Word versions from 2003 onwards. Please note, you cannot use this form anymore. Below you will find the link with alternative templates based on U.S. states to download.

Is there a template for writing a will?

Writing a will was never that easy, since with the help of will templates, available for free, you can cover all aspects to be addressed, from assigning an executor to handle your physical and financial assets to choosing a guardian for your minors.

What should you never put in your will?

Typically, your Last Will should not cover the following things:

- your funeral plans;

- illegal requests or gifts;

- life assurance and retirement funds;

- jointly owned property;

- digital assets.

Can an executor take everything?

An executor has the duty towards the beneficiaries and must manage the property in a way they manage their own estate and must take care with assets. However, it is important to remember that an executor cannot implement a will before the grantor passes away.

How do you write a simple will for free?

On our website you can follow a simple route to create for free your Last will and Testament:

- Type in your general personal information (name, address, family status and children).

- Specify who will be an Executor of a Will.

- Detail how your physical and financial assets shall be distributed.

- Download the document you have created and save it in any of these formats: Adobe. pdf or editable .docx

Where should you keep your will?

It is often your Executor who keeps your Will safe. You can use a sealed envelope to store your Will, as well as to ask your Executor to open it only after your demise, in case you wish so.

What happens to your will when your lawyer dies?

If you worry about losing your Will, you may store it in your lawyer’s safe. However, sometimes sad things happen, and you may want to know what to expect in case of your lawyer’s death. If this happens or your lawyer retires, his staff should email your will to you and your husband or wife.

Are online wills legitimate?

No will is a much worse-case scenario than an online will. With the age, your property and assets will increase, that is why you can always modify later your will with the help of codicil. It is possible that at that time you will prefer to refer to a legal authority and to create an estate plan. Alternatively, you can always opt for writing a new will, still online.